Rothschild Blackrock: The Powerhouse Alliance In Global Finance

When you hear the names Rothschild and BlackRock, you're diving into a world where wealth, influence, and strategic financial moves collide. These aren't just names; they're empires built on centuries of expertise and billions in assets. Imagine a partnership that combines the legacy of one of the oldest banking families with the modern financial giant managing trillions of dollars. This isn't just finance; it's power. And today, we're going to peel back the layers, uncover the truth, and give you the inside scoop on what makes Rothschild BlackRock a force to be reckoned with.

Now, you might be wondering why this matters to you. If you're into investments, global markets, or just curious about how the world's financial systems work, this is your gateway. Understanding these players isn't just for the elite; it's for anyone who wants to know what's really going on behind the scenes. So, buckle up, because we're about to dive deep into the world of Rothschild BlackRock.

But before we get into the nitty-gritty, let's set the stage. This isn't just a story about money. It's about legacy, innovation, and the intricate web of relationships that shape our global economy. By the end of this, you'll have a clearer picture of how these two giants have shaped the financial landscape and why their alliance is crucial to understand in today's market.

Understanding the Rothschild Legacy

Let's rewind the clock and talk about the Rothschilds. This isn't just any family; it's the family that practically invented modern banking. Starting in the 18th century, the Rothschilds built a banking empire that spanned Europe. They were the go-to financiers for kings, queens, and even entire nations. Their influence was so vast that they were often whispered to control the world's financial systems from the shadows. But don't get it twisted; this isn't just some conspiracy theory. The Rothschilds were legit.

Fast forward to today, and the Rothschilds are still in the game. They've adapted to the modern world, shifting their focus from traditional banking to asset management, private equity, and more. The family's wealth and influence have only grown, and they've partnered with some of the biggest names in finance. Enter BlackRock, the giant of the modern financial world.

Key Facts About the Rothschilds

- Founded by Mayer Amschel Rothschild in the late 18th century.

- Operated in five major European cities: Frankfurt, London, Paris, Vienna, and Naples.

- Known for their role in financing wars, monarchies, and infrastructure projects.

BlackRock: The Modern Giant

Now, let's talk about BlackRock. This isn't your average investment firm. Founded in 1988, BlackRock has grown to become the world's largest asset manager, overseeing trillions of dollars in assets. They've revolutionized the way we think about investing, using cutting-edge technology and data analytics to drive decision-making. BlackRock isn't just about managing money; it's about shaping the future of finance.

- Free Movie Streaming Guide Find Legal Sites Alternatives

- Movierulz Is It Safe Latest Updates Legal Streaming Alternatives

What sets BlackRock apart is its commitment to innovation. They've developed tools like Aladdin, a risk management platform that helps investors make smarter decisions. They're also at the forefront of sustainable investing, recognizing that environmental, social, and governance (ESG) factors are crucial in today's market. But here's the kicker: BlackRock isn't just about size; it's about influence. They have a seat at the table when it comes to shaping global financial policies.

BlackRock's Influence in Global Markets

- Manages over $10 trillion in assets as of 2023.

- Known for its role in shaping global financial regulations.

- Leads the charge in sustainable investing and ESG initiatives.

The Rothschild Blackrock Alliance

Now, here's where things get interesting. The partnership between Rothschild and BlackRock isn't just a handshake deal; it's a strategic alliance that combines centuries of expertise with modern financial innovation. In 2018, the Rothschild family merged their asset management business with BlackRock, creating a powerhouse that could dominate the industry. This wasn't just a merger; it was a marriage of old money and new ideas.

What does this mean for the financial world? It means that the Rothschilds, with their deep understanding of global markets and historical perspective, can now leverage BlackRock's cutting-edge technology and vast resources. And for BlackRock, it means gaining access to the Rothschilds' extensive network and legacy of trust. This partnership isn't just about money; it's about creating a new paradigm in finance.

Why This Alliance Matters

- Combines traditional banking expertise with modern asset management.

- Creates opportunities for innovation in financial products and services.

- Enhances the ability to influence global financial policies.

Rothschild Blackrock: The Numbers Game

Let's talk numbers. The financial world runs on data, and the Rothschild BlackRock alliance is no exception. Together, they manage trillions of dollars in assets, with a reach that spans the globe. But it's not just about the size of their portfolios; it's about the impact they have on the markets. Their decisions can move stock prices, influence currencies, and shape economic policies.

And here's the thing: the numbers don't lie. BlackRock's annual reports show consistent growth in assets under management, while the Rothschilds continue to expand their influence in private equity and real estate. Together, they're creating a financial ecosystem that's both robust and adaptable. But remember, this isn't just about the numbers; it's about the people behind them and the decisions they make.

Key Statistics

- Combined assets under management exceed $15 trillion.

- Rothschild family controls over $400 billion in private assets.

- BlackRock's ESG funds have grown by over 50% in the past year.

Global Impact of Rothschild Blackrock

The impact of Rothschild BlackRock extends far beyond the boardrooms of Wall Street and London. Their decisions affect everything from pension funds to emerging markets. When they invest in a country or sector, it can lead to increased economic activity and job creation. But it's not all sunshine and rainbows. Critics argue that their influence can lead to market manipulation and inequality. It's a balancing act that requires transparency and accountability.

One of the most significant impacts of the alliance is in the area of sustainable investing. Both Rothschild and BlackRock have made commitments to reducing carbon footprints and promoting ESG practices. This isn't just about being eco-friendly; it's about recognizing that the future of finance is tied to the health of our planet. And let's be real, if anyone can make a difference, it's these guys.

Sustainable Investing Initiatives

- Committed to reducing carbon emissions by 50% by 2030.

- Investing heavily in renewable energy and green technologies.

- Partnering with governments and NGOs to promote sustainable development.

Challenges Facing Rothschild Blackrock

Of course, it's not all smooth sailing. The financial world is complex, and the Rothschild BlackRock alliance faces its share of challenges. From regulatory scrutiny to geopolitical tensions, there are plenty of obstacles to navigate. And let's not forget the ever-present threat of market volatility. But here's the thing: these challenges also present opportunities for growth and innovation.

One of the biggest challenges is maintaining transparency and trust. In an era where consumers demand more from their financial institutions, the alliance must be vigilant in ensuring that their practices align with public expectations. This means being open about their investments, fees, and decision-making processes. It's a tall order, but one that they seem committed to tackling head-on.

Overcoming Challenges

- Investing in technology to improve transparency and accountability.

- Engaging with stakeholders to understand their concerns and expectations.

- Adapting to changing regulatory environments and market conditions.

Future Prospects for Rothschild Blackrock

So, what does the future hold for Rothschild BlackRock? The possibilities are endless. As the financial world continues to evolve, the alliance is well-positioned to lead the charge. They have the resources, expertise, and vision to shape the future of finance. But it's not just about maintaining their dominance; it's about creating a financial system that works for everyone.

One area to watch is the rise of digital currencies and blockchain technology. Both Rothschild and BlackRock have shown interest in this space, recognizing its potential to disrupt traditional banking systems. It's a bold move, but one that could pay off big time. The future of finance is digital, and these guys are ready to embrace it.

Innovations to Watch

- Exploring the potential of digital currencies and blockchain technology.

- Developing new financial products and services for the digital age.

- Expanding their reach into emerging markets and untapped regions.

Conclusion: Why Rothschild Blackrock Matters to You

So, there you have it. The world of Rothschild BlackRock is complex, fascinating, and full of opportunities. Whether you're an investor, a student of finance, or just someone curious about how the world works, understanding this alliance is crucial. It's not just about money; it's about power, influence, and the future of finance.

Now, here's the call to action: take what you've learned and apply it. Whether it's by investing in sustainable funds, staying informed about financial news, or simply understanding the forces that shape our world, you have the power to make a difference. So, share this article, leave a comment, and let's keep the conversation going. Because when it comes to Rothschild BlackRock, the story is just beginning.

Table of Contents

- Understanding the Rothschild Legacy

- BlackRock: The Modern Giant

- The Rothschild Blackrock Alliance

- Rothschild Blackrock: The Numbers Game

- Global Impact of Rothschild Blackrock

- Challenges Facing Rothschild Blackrock

- Future Prospects for Rothschild Blackrock

- Conclusion: Why Rothschild Blackrock Matters to You

- Kannada Movies 2025 New Releases Watch Online Legal Options

- Decoding Movie Rules From Tarantino To Movierulz Beyond

Black Special Eva Rothschild Eva Rothschild

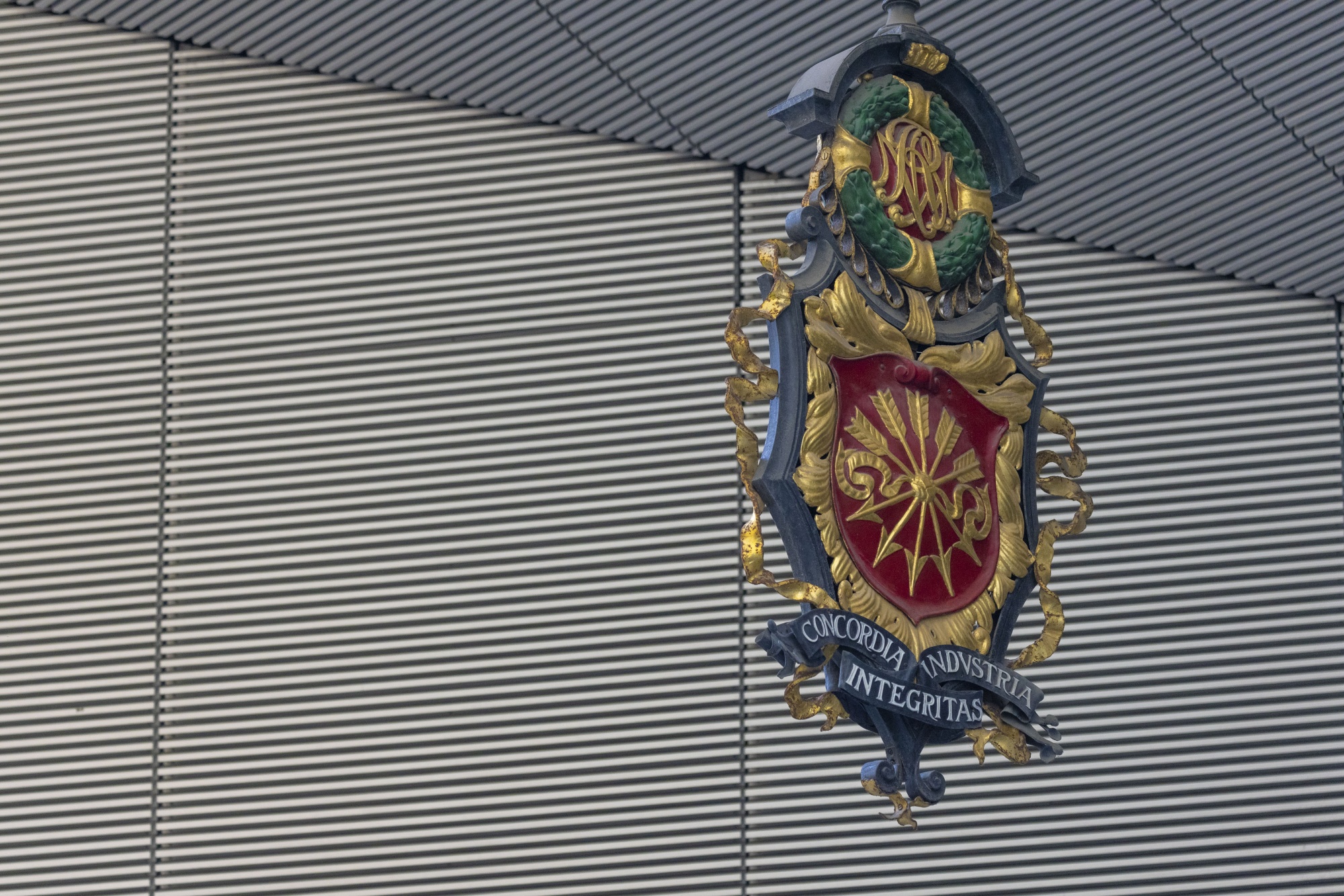

Rothschild Family

Rothschild logo Cut Out Stock Images & Pictures Alamy